Ripple’s XRP continues to show weakness amid broader market sell-offs. Despite several bounce attempts, both the USDT and BTC pairs are struggling below key resistance levels. Buyers have failed to reclaim momentum, and the price action remains confined within bearish structures.

XRP Price Technical Research

By Shayan

The USDT Pair

XRPUSDT broke down decisively from the descending channel structure and is now trading below the $2 key support level, which has now turned into a resistance zone. The recent move has been sharp, with the price falling toward the next major demand area around $1.75.

The RSI is also nearing oversold levels, currently around 30, which may suggest a short-term bounce. However, without reclaiming the $2 level, the structure remains bearish. If selling pressure continues, the next downside target lies near the $1.50 range.

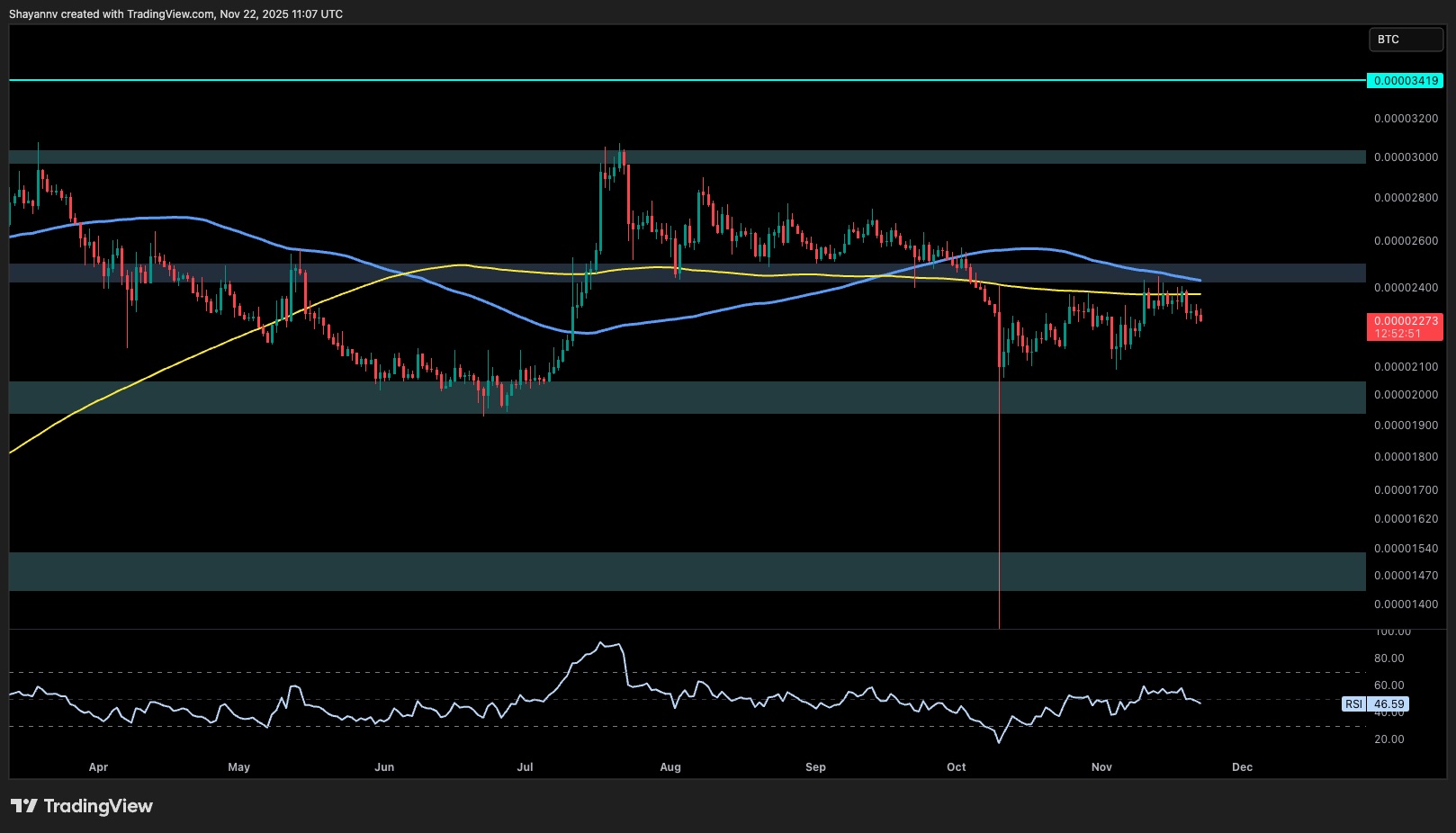

The BTC Pair

Against Bitcoin, XRP is showing relative weakness as well. The price is struggling to hold above the 2,200 SAT mark and has failed to break through the confluence of the 100-day and 200-day moving averages, both acting as dynamic resistance near the 2,400 SAT zone, which is a major barrier to upside continuation itself.

The RSI on this pair is neutral around 46, signaling that the market still lacks momentum in either direction. A breakdown below the 2,000 SAT support level could trigger a further decline toward the 1,700 SAT zone and even deeper toward the critical 1,500 SAT area.

The post Ripple Price Analysis: What’s Next for XRP as Weakness Against BTC and USD Extends appeared first on CryptoPotato.