Momentum around PENGU has thinned out, and the market is starting to notice. Where other memecoins are at least holding steady, PENGU keeps slipping lower, showing clear signs of pressure. With sentiment turning cautious and buyers stepping back, the next reaction from support could decide whether PENGU finds relief or slides even deeper.

PENGU Shows Clear Weakness Against Major Memecoins

PENGU continues to lag behind the broader meme sector, sliding further while others at least attempt minor stabilizations. The relative performance chart from Jesse Peralta shows that PENGU sitting at the bottom of the group, dropping deeper into negative territory, while DOGE, BONK, and PEPE hold slightly higher. This consistent underperformance suggests a weakening trend and declining buyer confidence.

PENGU continues to lag behind major memecoins, extending its decline while peers show mild stability. Source: Jesse Peralta via X

The structure also reflects heavy distribution, with each bounce failing to recover previous highs. As long as Pudgy Penguins remains at the bottom of the performance stack, sentiment is likely to remain cautious.

PENGU Price Prediction: Trend Still Sloping Lower

The descending structure remains intact, with PENGU repeatedly failing to break above its diagonal resistance. Lamatrade’s chart shows price still respecting a long-term downtrend while forming lower highs across each reaction. Support near $0.01040 remains the key defense zone before any deeper shakeout occurs.

Pudgy Penguins continues to respect its descending trendline, pressing towards the crucial $0.01040 support as downside pressure builds. Source: Lamatrade via X

Below this area, the chart highlights a final liquidity sweep towards the $0.005 to $0.006 zone if momentum weakens further. Until the descending trendline is reclaimed, any recovery attempts risk becoming short-lived. A clean close above the $0.020–$0.022 band would be needed to confirm a structural shift.

PENGU Testing a Key S/R Cluster Once Again

PENGU is hovering right above a critical support area around $0.0139, the same zone that has repeatedly generated bounces in recent days. The chart also shows a clearly defined resistance block between $0.0153 to $0.0156, which previously rejected price and remains a major S/R pivot. Pudgy Penguins price is now squeezed between these two levels, leaving little room for indecision.

PENGU trades tightly between a key support at $0.0139 and resistance near $0.0156, forming a crucial S/R squeeze that will define its next move. Source: AleksanderTraderX via X

If this lower band fails, downside continuation towards $0.0130 or even $0.0128 becomes likely. But if this support holds and triggers a reaction, AleksanderTraderX will look for a reclaim of the mid-range to confirm strength. For now, the setup sits right at a make-or-break region.

Will PENGU Break Its Downtrend?

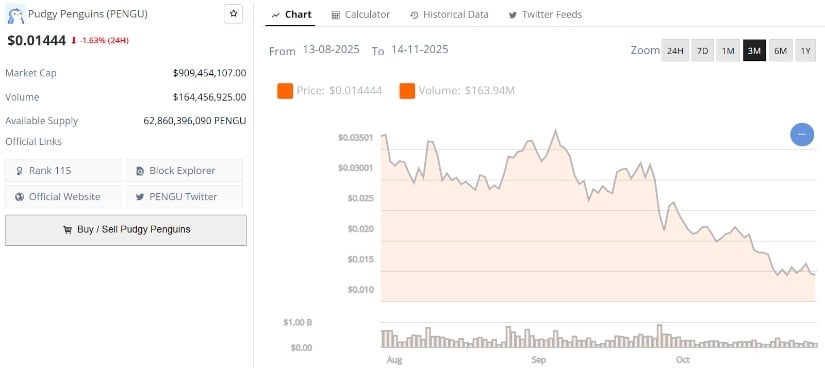

The broader 3-month structure from Brave New Coin shows a clear, steady bleed in price with lower highs and lower lows forming consistently. Volume has been declining over the same period, suggesting less follow-through on both rallies and sell-offs.

Pudgy Penguins’ current price is $0.01444, down -1.63% in the last 24 hours. Source: Brave New Coin

This lack of volume makes it harder for bulls to force meaningful reversals. Price remains pinned near $0.014 after failing to hold earlier support levels near $0.018 and $0.020. As long as volume stays weak and downtrend pressure continues, PENGU may struggle to form a proper base. A shift in momentum would require fresh demand and a break of near-term trendlines.

Final Thoughts

PENGU continues to sit in a vulnerable zone, weighed down by persistent lower highs, weakening momentum, and deteriorating volume. Most market watchers agree that the trend remains bearish until key resistance zones are reclaimed. However, major support levels are now close, and reaction from these areas will decide whether a broader recovery can develop.

For now, the structure leans cautious, and the PENGU Pudgy Penguins price is reaching levels where buyers historically showed interest, but without volume returning, the downtrend remains in full control.